Ascending Flag Pattern

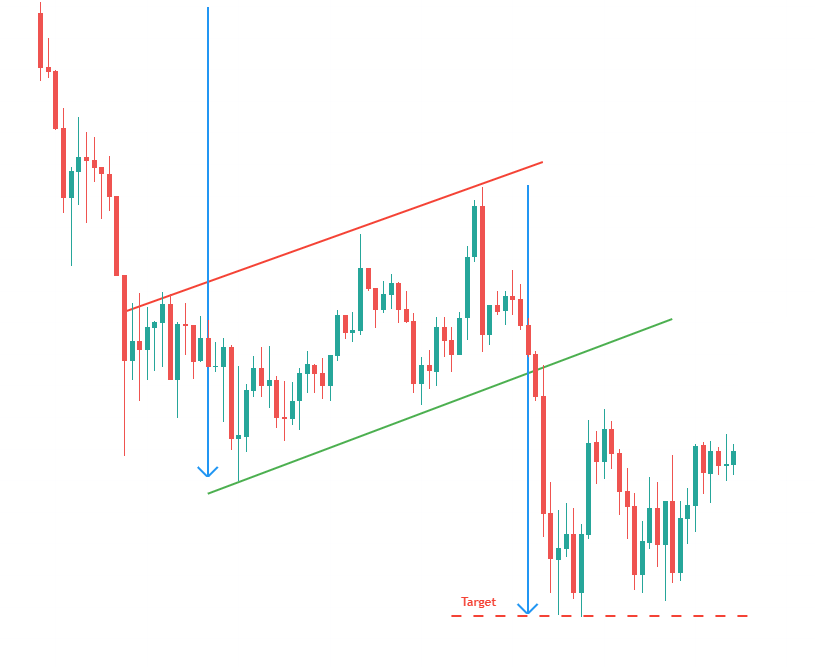

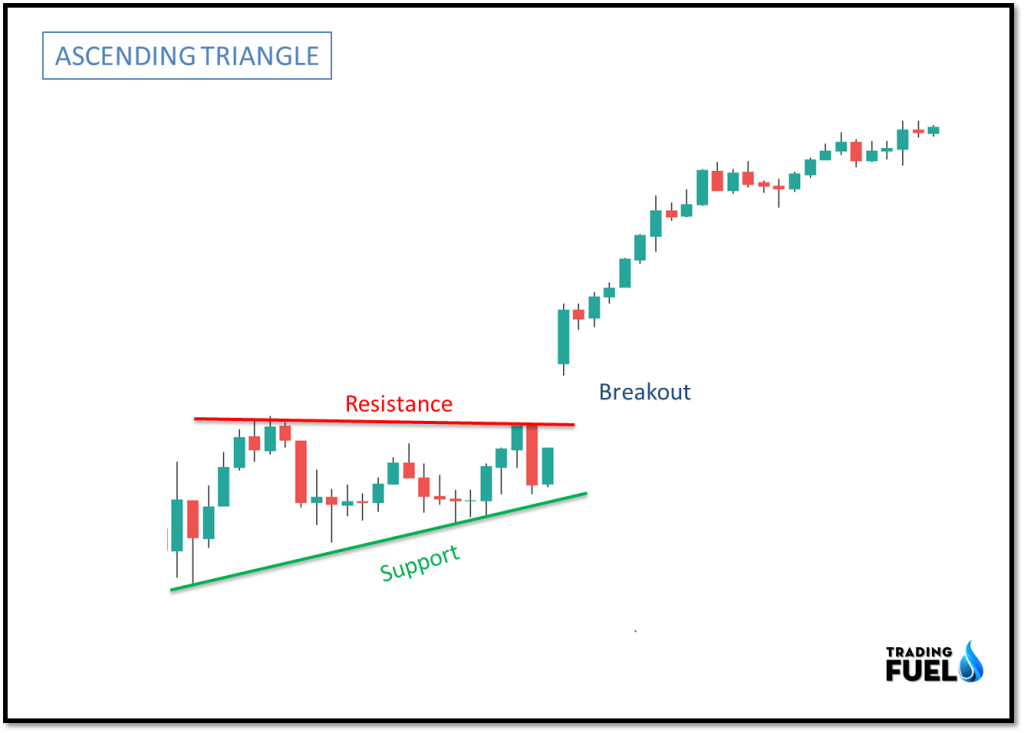

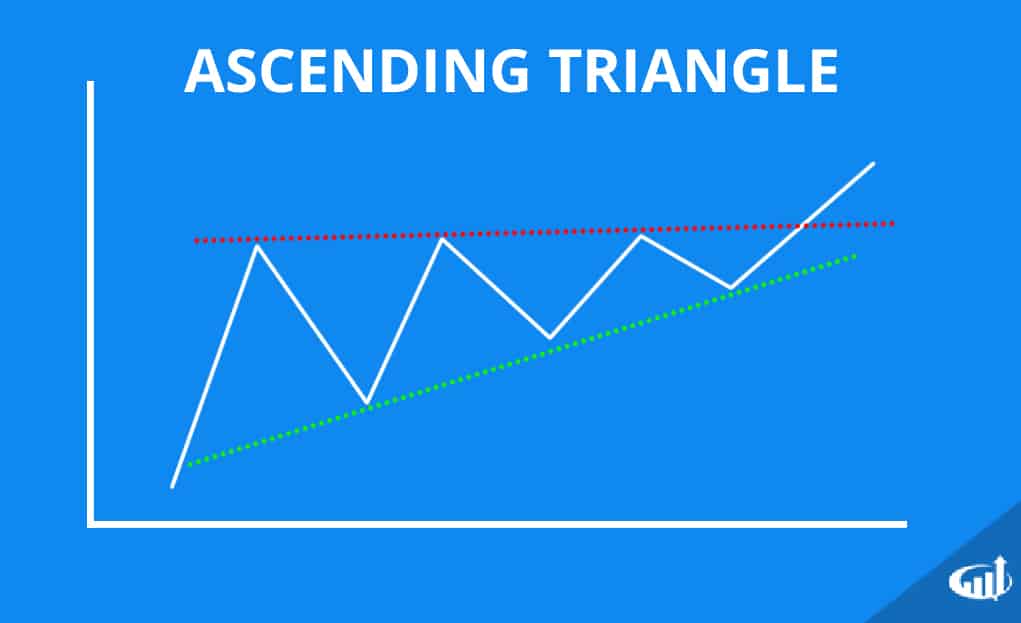

Ascending Flag Pattern - This pattern indicates that buyers are. Read on to learn more about the bull flag and its use in your financial markets trading. What is the trend continuation pattern? It is considered a continuation pattern, indicating that the prevailing trend is likely to continue after a brief consolidation or pause. Web a flag pattern is a continuation chart pattern, named due to its similarity to a flag on a flagpole. Web an ascending bull flag pattern is a chart formation that occurs when the market consolidates after a sharp upward move. Web the ascending triangle pattern is a bullish continuation pattern frequently observed on exchange rate charts by forex traders using technical analysis. Web an ascending triangle is a chart pattern that occurs when the price of a stock or other asset is consolidating in a tight range and is forming higher lows. You can time your trades with this simple pattern and ride the trend if you missed the start of the trend. Example of trend continuation patterns. Example of trend continuation patterns. Web the ascending triangle is a bullish continuation pattern and is characterized by a rising lower trendline and a flat upper trendline that acts as support. It is considered a continuation pattern, indicating that the prevailing trend is likely to continue after a brief consolidation or pause. Web the ascending triangle formation is a very powerful chart pattern that exploits the supply and demand imbalances in the market. Web an ascending flag is a continuation pattern. Traders and investors observe this pattern to identify trends in the. Web the “bull flag” or “bullish flag pattern” is a powerful indicator for trading uptrends or topside market breakouts. Web a flag pattern is a continuation chart pattern, named due to its similarity to a flag on a flagpole. Read on to learn more about the bull flag and its use in your financial markets trading. The ascending flag is formed by two straight upward parallel lines which are shaped like a rectangle. Web a bull flag is an uptrend continuation chart pattern in the stock market or an individual stock that signals that a bullish trend is likely to persist. Web the “bull flag” or “bullish flag pattern” is a powerful indicator for trading uptrends or topside market breakouts. Web the following diagram shows the three basic types of triangle chart patterns:. Web a flag pattern is a continuation chart pattern, named due to its similarity to a flag on a flagpole. Web ascending triangle chart pattern. Web an ascending triangle is a chart pattern that occurs when the price of a stock or other asset is consolidating in a tight range and is forming higher lows. This pattern indicates that buyers. Web the “bull flag” or “bullish flag pattern” is a powerful indicator for trading uptrends or topside market breakouts. Although it is less popular than triangles and wedges, traders consider flags to be extremely reliable chart patterns. It has a horizontal resistance level with a sloping support level, which creates higher lows. This pattern is characterized by a rectangle formed. Web the ascending triangle pattern is a bullish continuation pattern frequently observed on exchange rate charts by forex traders using technical analysis. Web an ascending triangle is a chart pattern that occurs when the price of a stock or other asset is consolidating in a tight range and is forming higher lows. Web the ascending triangle formation is a very. Web a bull flag is an uptrend continuation chart pattern in the stock market or an individual stock that signals that a bullish trend is likely to persist. Web an ascending flag is a continuation pattern. It is considered a continuation pattern, indicating that the prevailing trend is likely to continue after a brief consolidation or pause. You can time. A bullish flag appears like an. This pattern indicates that buyers are. It is considered a continuation pattern, indicating that the prevailing trend is likely to continue after a brief consolidation or pause. Web the “bull flag” or “bullish flag pattern” is a powerful indicator for trading uptrends or topside market breakouts. Traders and investors use bull flags to identify. It is considered a continuation pattern, indicating that the prevailing trend is likely to continue after a brief consolidation or pause. The ascending, descending, and symmetrical triangles. Web an ascending flag is a continuation pattern. Web ascending triangle chart pattern. Web a flag pattern is a type of technical chart pattern that appears when there is a significant price movement. Web ascending triangle chart pattern. Web the ascending triangle pattern is a bullish continuation pattern frequently observed on exchange rate charts by forex traders using technical analysis. Web flag patterns in forex trading help identify the continuations of previous trends from a point at which the price swayed away against the same trend. This pattern indicates that buyers are. The. Web the following diagram shows the three basic types of triangle chart patterns: Web the ascending triangle is a bullish continuation pattern and is characterized by a rising lower trendline and a flat upper trendline that acts as support. A bullish flag appears like an. It is adjusted in the direction of the trend that it consolidates. Web a flag. Flag patterns are accompanied by. It has a horizontal resistance level with a sloping support level, which creates higher lows. Example of trend continuation patterns. Web the ascending triangle formation is a very powerful chart pattern that exploits the supply and demand imbalances in the market. The ascending triangle pattern is formed when there is a clear resistance level and. Web the ascending triangle pattern is a bullish continuation pattern frequently observed on exchange rate charts by forex traders using technical analysis. Web a bull flag is an uptrend continuation chart pattern in the stock market or an individual stock that signals that a bullish trend is likely to persist. Web an ascending flag is a continuation pattern. It is adjusted in the direction of the trend that it consolidates. Web the rising wedge is a technical chart pattern used to identify possible trend reversals. Example of trend continuation patterns. Traders and investors observe this pattern to identify trends in the. It signals that an uptrend is likely to continue. What is the trend continuation pattern? The ascending triangle pattern is formed when there is a clear resistance level and price begins making a series of higher lows to form the triangle. Traders and investors use bull flags to identify a potential entry into the next leg of an uptrend. Web an ascending triangle is a chart pattern that occurs when the price of a stock or other asset is consolidating in a tight range and is forming higher lows. Web a flag pattern is a continuation chart pattern, named due to its similarity to a flag on a flagpole. We go into more detail about what they are and how they work. Web flag patterns in forex trading help identify the continuations of previous trends from a point at which the price swayed away against the same trend. This classic chart pattern is formed.NEOUSD Bullish Ascending Triangle / Bearish Flag Pattern for BITFINEX

Patterns Blockunity

Triangle Pattern, Flag Pattern & More.. (Continuation Chart Pattern

Ascending flag pattern for KUCOINLUNCUSDT by hojjat63 — TradingView

Ascending Flag Chart Pattern

Ascending Flag pattern in USDINR for OANDAUSDINR by jgarge84 — TradingView

Ascending flag pattern in idea for KUCOINIDEAUSDT by Tirozh_Group

Trading the Ascending Wedge, Bullish flag patterns YouTube

AUDCAD Ascending Bearish Relief flag for FXAUDCAD by JasonGraystone

Ascending flag pattern for BINANCEENJUSDT by Morteza_Khedri — TradingView

Web A Flag Pattern Is A Technical Analysis Chart Pattern That Can Be Observed In The Price Charts Of Financial Assets, Such As Stocks, Currencies, Or Commodities.

Web The Ascending Triangle Is A Bullish Continuation Pattern And Is Characterized By A Rising Lower Trendline And A Flat Upper Trendline That Acts As Support.

Read On To Learn More About The Bull Flag And Its Use In Your Financial Markets Trading.

Although It Is Less Popular Than Triangles And Wedges, Traders Consider Flags To Be Extremely Reliable Chart Patterns.

Related Post: