Candlestick Patterns Spinning Top

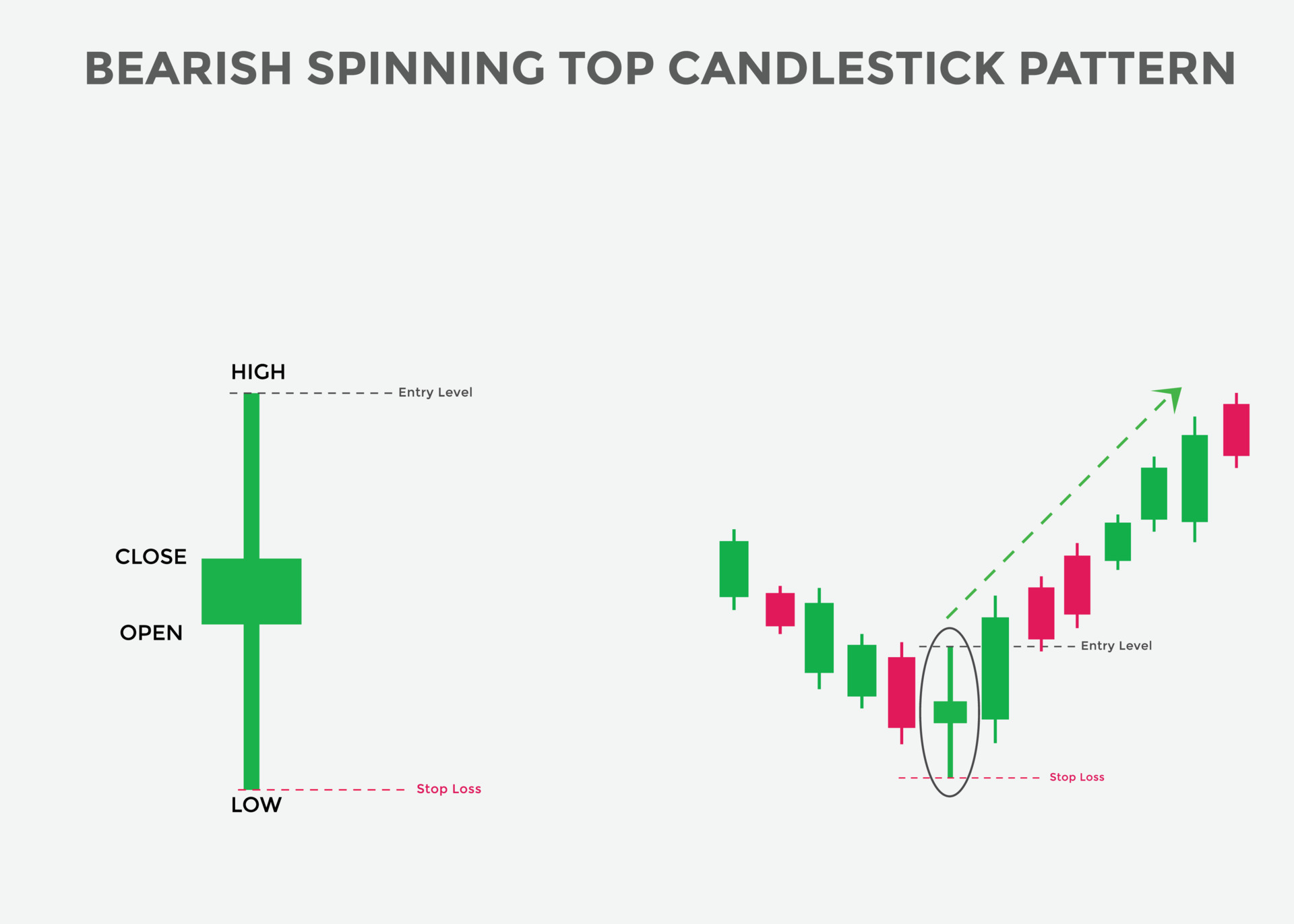

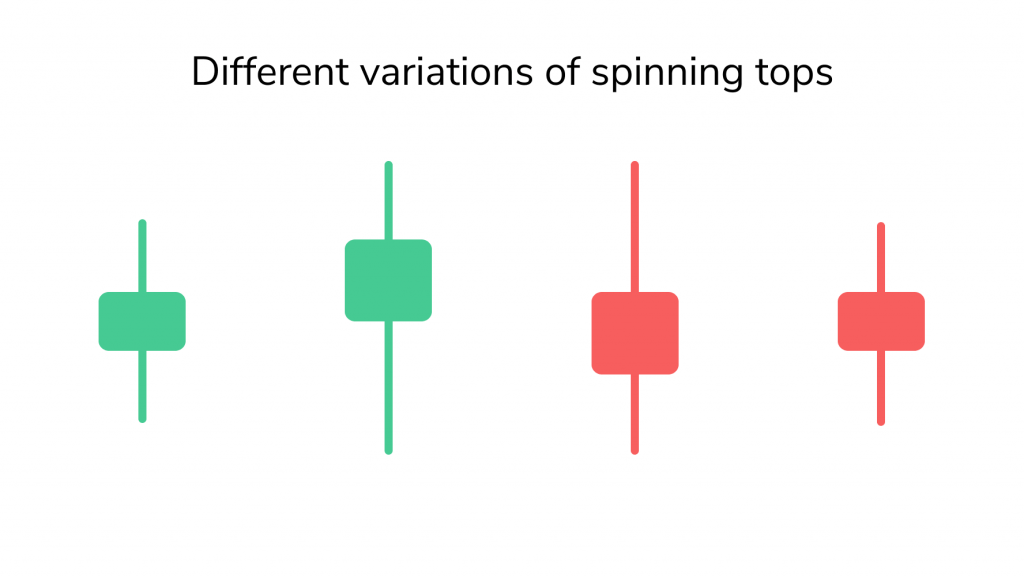

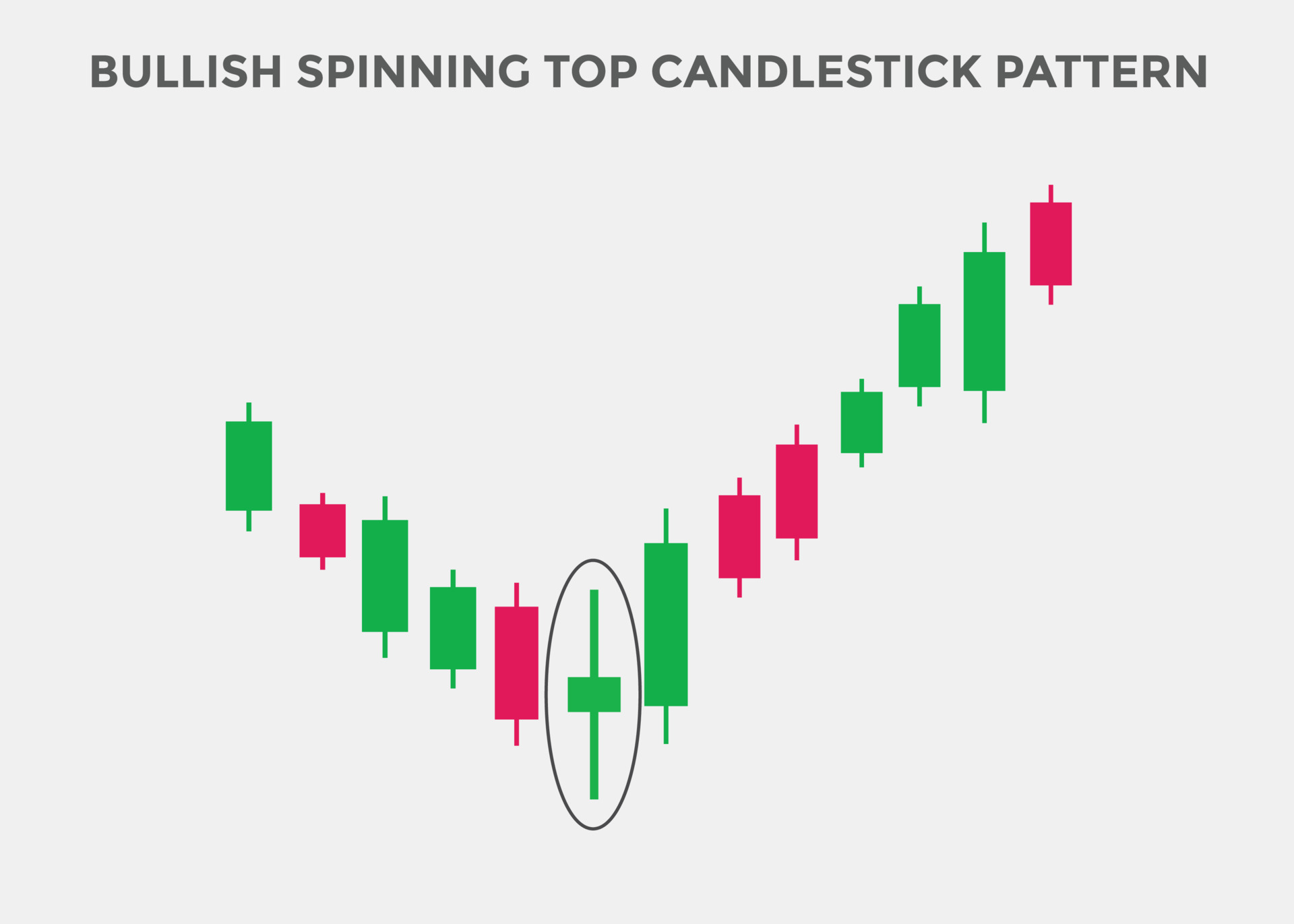

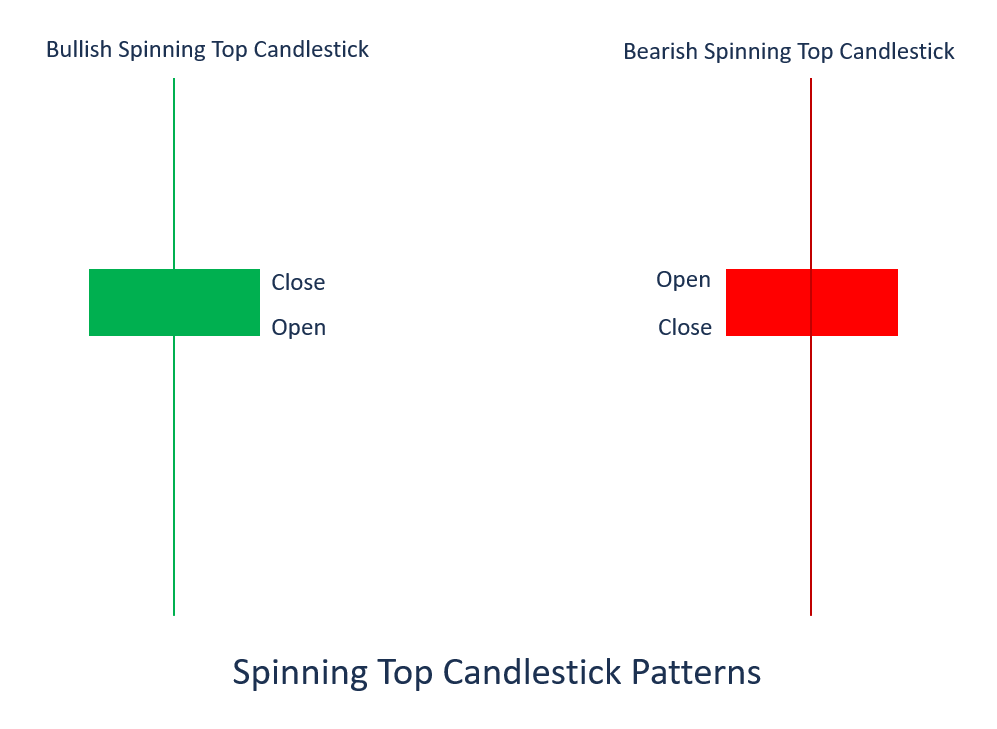

Candlestick Patterns Spinning Top - You’ll also learn how to trade when you spot the spinning top pattern. The candlestick pattern represents indecision about the. By examining the shape and color of the candlestick, traders can gauge market sentiment and potential future movements. Web what is a spinning top in candlestick patterns? They emerge when bullish and bearish forces, speculating on price rise and decline, respectively, are evenly matched, resulting in a minimal net price change. Web a spinning top is a candlestick formation that signals indecision regarding the future trend direction. The body represents the range between the open and close prices…. This candlestick pattern has a short real body with long upper and lower shadows of almost equal lengths. Web the simplest candlestick patterns involve just one day or one period of price data, and you can find information on those patterns in chapters 5 and 6. To confirm this reversal, see what pattern it is a part of. If a spinning top candlestick forms at the end of a head and shoulders pattern, look out for a bearish reversal coming. Web jan 10, 2017 •. Web the spinning top is a candlestick pattern that signals indecision between buyers and sellers and may indicate a possible trend reversal. The japanese candlestick chart patterns are the most popular way of reading trading charts. Spinning top candlestick is a pattern with a short body between an upper and a lower long wick. Web a spinning top is a candlestick pattern with a short real body that's vertically centered between long upper and lower shadows. The bulls sent the price higher, while the bears pushed it low again. They emerge when bullish and bearish forces, speculating on price rise and decline, respectively, are evenly matched, resulting in a minimal net price change. A spinning top that is built to last forever. Similar to a doji pattern, a spinning top is considered a neutral pattern, although many do end in reversals. It explains that candlesticks show the battle between buyers and sellers over a period of time. Web read about the spinning top candlestick chart pattern, including what causes it to form and how to identify it. The wicks show the highest and lowest prices reached during the trading session…. This candlestick pattern has a short real body with long upper. The bulls sent the price higher, while the bears pushed it low again. Our girls will be 4 (turning 5) and 2 1/2. A spinning top that is built to last forever. The document discusses candlestick patterns and how to interpret them. To confirm this reversal, see what pattern it is a part of. Web the spinning top candlestick is a fascinating puzzle for traders seeking crucial market insights! Spinning top candlestick is a pattern with a short body between an upper and a lower long wick. Our girls will be 4 (turning 5) and 2 1/2. The wicks show the highest and lowest prices reached during the trading session…. It explains that candlesticks. Web a spinning top candlestick is a type of japanese candlestick charting pattern that traders use to analyze price behavior in financial markets. Web the spinning top is a candlestick pattern that signals indecision between buyers and sellers and may indicate a possible trend reversal. Web read about the spinning top candlestick chart pattern, including what causes it to form. Web what is a spinning top in candlestick patterns? Web a spinning top candlestick is a chart pattern that forms over a single session. It explains that candlesticks show the battle between buyers and sellers over a period of time. Web candlesticks are created with a body and wicks (or shadows). Spinning tops form when the bulls and bears battle. Web a spinning top is a candlestick formation that signals indecision regarding the future trend direction. It is another common and effective candlestick reversal pattern used by traders to. By examining the shape and color of the candlestick, traders can gauge market sentiment and potential future movements. Web the spinning top is a candlestick pattern that signals indecision between buyers. The japanese candlestick chart patterns are the most popular way of reading trading charts. Web key takeaways for trading the spinning top candlestick pattern: Web jan 10, 2017 •. Web a spinning top candlestick is a type of japanese candlestick charting pattern that traders use to analyze price behavior in financial markets. Our girls will be 4 (turning 5) and. A spinning top that is built to last forever. Web what is a spinning top in candlestick patterns? The spinning top candlestick pattern has a short body centred between wicks of equal length. The document discusses candlestick patterns and how to interpret them. Web what is spinning top candlestick? Our girls will be 4 (turning 5) and 2 1/2. These can help traders to identify a period of rest in the market, when there is market indecision or neutral price movement. The document discusses candlestick patterns and how to interpret them. Web a spinning top candlestick is a type of japanese candlestick charting pattern that traders use to analyze. The bears, of course, don’t like this. It has a small body closing in the middle of the candle’s range, with long wicks on both sides. The japanese candlestick chart patterns are the most popular way of reading trading charts. Similar to a doji pattern, a spinning top is considered a neutral pattern, although many do end in reversals. It. The spinning top illustrates a scenario where neither the seller nor the buyer has gained. The spinning top candlestick pattern has a short body centred between wicks of equal length. Web a spinning top is a candlestick pattern that indicates uncertainty. Spinning tops form when the bulls and bears battle for control of price, but neither side can overwhelm the other. It's characterized by a small body situated between long upper and lower wicks. Web a spinning top candlestick is a type of japanese candlestick charting pattern that traders use to analyze price behavior in financial markets. Web what is a spinning top in candlestick patterns? Web a spinning top candlestick is a chart pattern that forms over a single session. The japanese candlestick chart patterns are the most popular way of reading trading charts. Web known as spinning top candlesticks, they signal indecision in the market. First, the bulls push price beyond the open, causing the candle to turn bullish. Web the simplest candlestick patterns involve just one day or one period of price data, and you can find information on those patterns in chapters 5 and 6. Spinning top candlestick is a pattern with a short body between an upper and a lower long wick. Web spinning top candlestick patterns are indicative of market uncertainty regarding future price movements. Web spinning top candlesticks can form a the the top or bottom of a pattern, signaling the end of a trend. Web jan 10, 2017 •.Trading with the Spinning Top Candlestick

Bullish Spinning top candlestick pattern. Spinning top Bullish

Spinning Top Candlestick Pattern Forex Trading

Spinning Top Candlestick Pattern Overview, Formation, How To Trade

Spinning Top Candlestick Patterns Cheat Sheet

Spinning Top Candlestick Definition

Trading with the Spinning Top Candlestick

Bullish Spinning top candlestick pattern. Spinning top Bullish

How to Trade with the Spinning Top Candlestick IG International

What is a Spinning Top Candlestick Pattern TradeSanta

Because They Are Simple To Understand And Tend To.

These Can Help Traders To Identify A Period Of Rest In The Market, When There Is Market Indecision Or Neutral Price Movement.

It Has A Small Body Closing In The Middle Of The Candle’s Range, With Long Wicks On Both Sides.

The Document Discusses Candlestick Patterns And How To Interpret Them.

Related Post:

:max_bytes(150000):strip_icc()/dotdash_Final_Spinning_Top_Candlestick_Definition_and_Example_Nov_2020-01-9ebe4d0e8ccb482c92214128a29874de.jpg)