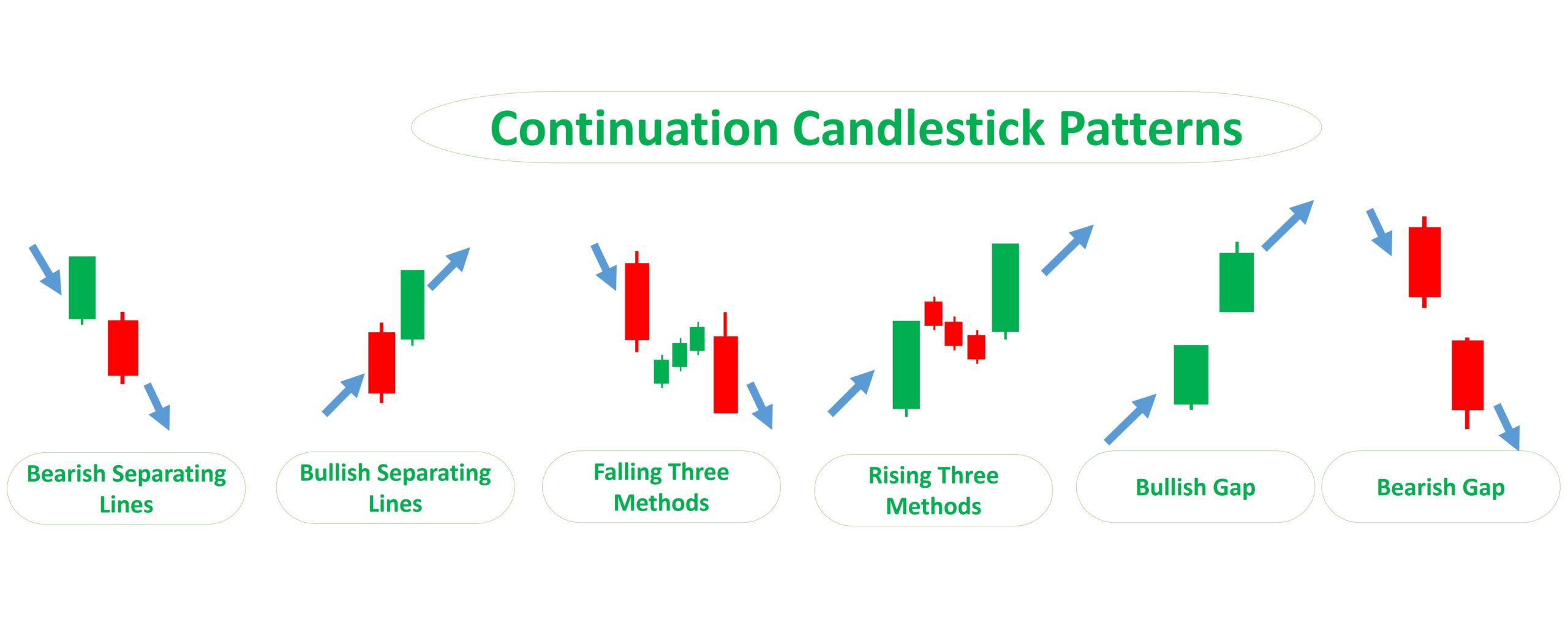

Continuation Candlestick Patterns

Continuation Candlestick Patterns - Let’s break down the basics: The body represents the opening and closing prices; Traders try to spot these patterns in the middle of an existing trend, and. Traders use these different patterns in studying participation in the market on the side of the demand or supply. Web understanding gaps is helpful for the reliable bullish continuation candlestick patterns that i’ll be sharing in this article. Here’s a table of the characteristics and significance of the upside tasuki gap bullish continuation candlestick pattern. It’s the opposite of price reversal points, as they indicate the likelihood of trends continuing in the same, higher direction. Web candlestick patterns are made up of individual “candles,” each showing the price movement for a certain time period. These can help traders to identify a period of rest in the market, when there is. Recognizing these patterns can provide valuable entry points and confirm the ongoing direction of price movements. A bullish pattern begins with a large bullish candle followed by a gap higher. These can help traders to identify a period of rest in the market, when there is market indecision or neutral price movement. Web continuation patterns are an indication traders look for to signal that a price trend is likely to remain in play. This pattern occurs when a small bearish candlestick is followed by a more significant bullish candlestick that completely engulfs the. Web understanding gaps is helpful for the reliable bullish continuation candlestick patterns that i’ll be sharing in this article. The thick part of the candle. It’s the opposite of price reversal points, as they indicate the likelihood of trends continuing in the same, higher direction. Web japanese candlestick bullish continuation patterns that tend to resolve in the same direction as the prevailing trend. Seek for distinct patterns that suggest possible continuance, such as pennants, flags, or certain candlestick forms like the doji, spinning top, or high wave. Web the continuation candlestick pattern signals a prevailing trend once the breakout is confirmed and after a temporary trading pause in the market. The body represents the opening and closing prices; Bullish, bearish, reversal, continuation and indecision with examples and explanation. And if you’re a trend trader, these candlestick patterns present some of the best trading opportunities out there. Web continuation patterns are an indication traders look for to signal that a price trend is likely to remain in play. Web continuation candlestick. Web here are a few commonly observed bullish continuation candlestick patterns: These can help traders to identify a period of rest in the market,. Web the continuation candlestick pattern signals a prevailing trend once the breakout is confirmed and after a temporary trading pause in the market. Continuation candlestick patterns signify the market is likely to continue trading in the. Web the form and traits of successive candlesticks within a trend can be used to identify continuation candlestick patterns. Recognizing these patterns can provide valuable entry points and confirm the ongoing direction of price movements. Seek for distinct patterns that suggest possible continuance, such as pennants, flags, or certain candlestick forms like the doji, spinning top, or high wave. Web. Web understanding gaps is helpful for the reliable bullish continuation candlestick patterns that i’ll be sharing in this article. Web 4.5 top 3 continuation candlestick patterns. The body represents the opening and closing prices; Traders use these different patterns in studying participation in the market on the side of the demand or supply. The thick part of the candle. There are dozens of different candlestick patterns with intuitive, descriptive. Continuation of an uptrend upside tasuki gap. Basic components of a candlestick. If a candlestick pattern doesn’t indicate a change in market direction, it is what is known as a continuation pattern. Web article shows the top 10 performing continuation candlesticks with links to descriptions and performance statistics, written by. Each candlestick represents a specific period of time (e.g., one hour, one day, one week) and consists of a body and wicks or shadows. So here are 4 continuation patterns you should know: These can help traders to identify a period of rest in the market, when there is. Web bearish japanese candlestick continuation patterns are displayed below from strongest. This pattern occurs when a small bearish candlestick is followed by a more significant bullish candlestick that completely engulfs the. Continuations tend to resolve in the same direction as the prevailing trend: Web if a candlestick pattern doesn’t indicate a change in market direction, it is what is known as a continuation pattern. Web continuation candlestick patterns. Seek for distinct. Web learn all about continuation and reversal candlestick patterns, how to trade candlestick bars, and the best strategies to profit from them! If a candlestick pattern doesn’t indicate a change in market direction, it is what is known as a continuation pattern. Web if a candlestick pattern doesn’t indicate a change in market direction, it is what is known as. Traders try to spot these patterns in the middle of an existing trend, and. Bullish, bearish, reversal, continuation and indecision with examples and explanation. Web if a candlestick pattern doesn’t indicate a change in market direction, it is what is known as a continuation pattern. Web understanding gaps is helpful for the reliable bullish continuation candlestick patterns that i’ll be. If a candlestick pattern doesn’t indicate a change in market direction, it is what is known as a continuation pattern. Web continuation candlestick patterns. These patterns suggest that the current trend is likely to continue. Web bearish japanese candlestick continuation patterns are displayed below from strongest to weakest. Web learn all about continuation and reversal candlestick patterns, how to trade. Web here are a few commonly observed bullish continuation candlestick patterns: It shows the difference between the opening and closing prices. These can help traders to identify a period of rest in the market, when there is market indecision or neutral price movement. Wednesday and ended the session at lows, forming what many. Candlestick pattern strength is described as. Web continuation candlestick patterns, being that they are usually spotted during technical analysis on an asset’s candlestick pattern, can indicate stronger or weaker price breakouts, as well as being signs of increased volatility. Traders use these different patterns in studying participation in the market on the side of the demand or supply. And if you’re a trend trader, these candlestick patterns present some of the best trading opportunities out there. There are dozens of different candlestick patterns with intuitive, descriptive. Web continuation patterns are an indication traders look for to signal that a price trend is likely to remain in play. The wicks show the highest and lowest prices during that period. Basic components of a candlestick. Web if a candlestick pattern doesn’t indicate a change in market direction, it is what is known as a continuation pattern. Web here are some tips to help you read candlestick charts. A bullish pattern begins with a large bullish candle followed by a gap higher. So here are 4 continuation patterns you should know:CANDLESTICK PATTERNS LEARNING = LIVING

Continuation Candlestick Patterns Cheat Sheet

Continuation Pattern Meaning, Types & Working Finschool

FOUR CONTINUATION CANDLESTICK PATTERNS YouTube

Continuation Candlestick Patterns Cheat Sheet

Continuation Candlestick Patterns Cheat Sheet

Bearish Continuation Candlestick Patterns

Continuation Pattern Meaning, Types & Working Finschool

Continuation Candlestick Patterns Cheat Sheet

Popular Candlestick Patterns and Categories TrendSpider Learning Center

Web Article Shows The Top 10 Performing Continuation Candlesticks With Links To Descriptions And Performance Statistics, Written By Internationally Known Author And Trader Thomas Bulkowski.

Here’s A Table Of The Characteristics And Significance Of The Upside Tasuki Gap Bullish Continuation Candlestick Pattern.

The Different Intensity Of These Trends Can Usually Be Noted In The Following Ways:

If A Candlestick Pattern Doesn’t Indicate A Change In Market Direction, It Is What Is Known As A Continuation Pattern.

Related Post: