Shooting Star Stock Pattern

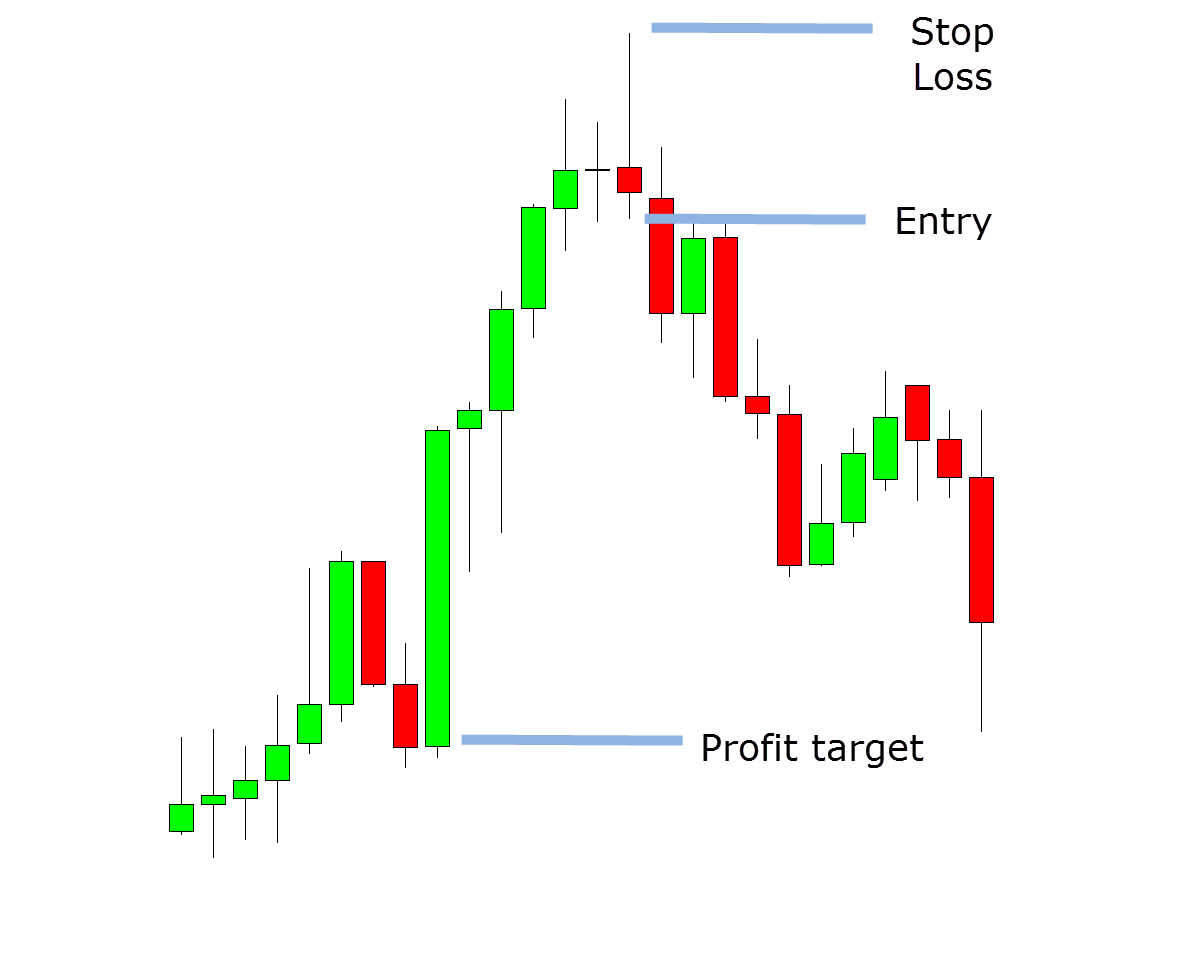

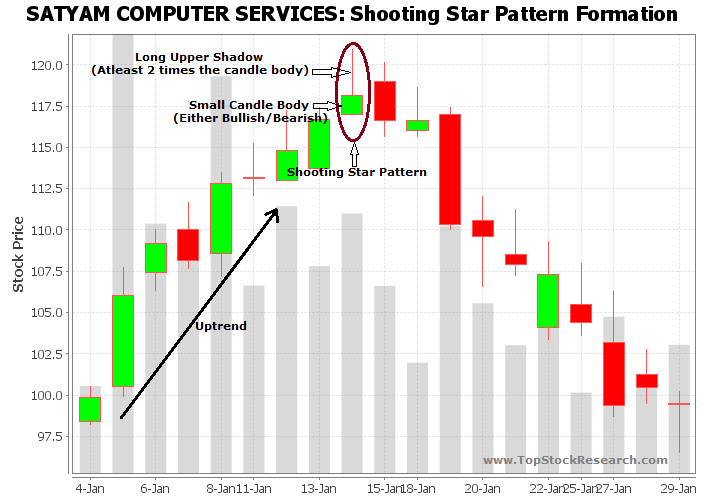

Shooting Star Stock Pattern - Web the shooting star pattern is a bearish reversal pattern that consists of just one candlestick and forms after a price swing high. Web the shooting star candlestick pattern is a bearish reversal pattern. Web here we introduce the shooting star pattern — a notable figure in candlestick charts that traders often view as a signal of bearish reversals. The inverted hammer occurs at the end of a down trend. Web a shooting star is a type of candlestick pattern that forms when the price of the security opens, rises significantly but then closes near the open price. Web what is a shooting star pattern? The formation is bearish because the price tried to rise significantly during the day, but. Morning, evening, doji, and shooting. It’s a reversal pattern believed to signal an imminent bearish trend reversal. This creates a long upper wick, a small lower wick and a small body. Web what is a shooting star pattern? After an uptrend, the shooting star pattern can signal to traders that the uptrend might be over and that long positions could potentially be reduced or completely exited. On the 1200 block of north alden. It is a bearish candlestick pattern characterized by a long upper shadow and a small real body. And this is what a shooting star means… It is also one of the four types of stars in candle theory: Web the shooting star pattern is a bearish reversal pattern that consists of just one candlestick and forms after a price swing high. The inverted hammer occurs at the end of a down trend. This pattern is characterized by a long upper shadow and a small real body near the low of the trading range, indicating potential weakness among the buyers. Web the shooting star candle is a reversal pattern of an upwards price move. As its name suggests, the shooting star is a small real body at the lower end of the price range with a long upper shadow. Web the shooting star is a candlestick pattern to help traders visually see where resistance and supply is located. For example, you can have a hammer candlestick pattern at the top of an uptrend which. It is also one of the four types of stars in candle theory: Each bullish candlestick should create a higher high. It is formed when the price is pushed higher and immediately rejected lower so that it leaves behind. Web what is a shooting star candlestick pattern? The pattern forms when a security price opens, advances significantly, but then retreats. This pattern is the most effective when it forms after a series of rising bullish candlesticks. That being said, you can also have variations of the two. After an uptrend, the shooting star pattern can signal to traders that the uptrend might be over and that long positions could potentially be reduced or completely exited. A shooting star occurs after. Similar to a hammer pattern, the shooting star has a long shadow that shoots higher, while the open, low, and close are near the bottom of the candle. Web the shooting star pattern reveals a significant price advance within a trading session, followed by selling pressure that brings the price back down near its open. Morning, evening, doji, and shooting.. Philadelphia (cbs) — three people died and seven others were injured in a shooting at a large gathering early sunday morning in the carroll park section of west philadelphia, police said. Web shooting star patterns indicate that the price has peaked and a reversal is coming. For example, you can have a hammer candlestick pattern at the top of an. Police responded to a call about gunshots shortly after 2 a.m. Web what is a shooting star pattern in candlestick analysis? Web shooting star candlestick is a bearish candlestick pattern which marks the top of price before reversal. The upper shadow is about 2 or 3 times the length of the body. Web a shooting star candlestick is a type. Police responded to a call about gunshots shortly after 2 a.m. As its name suggests, the shooting star is a small real body at the lower end of the price range with a long upper shadow. That being said, you can also have variations of the two. Web sun, july 21, 2024, 8:28 am edt · 1 min read. Similar. After an uptrend, the shooting star pattern can signal to traders that the uptrend might be over and that long positions could potentially be reduced or completely exited. The formation is bearish because the price tried to rise significantly during the day, but. Similar to a hammer pattern, the shooting star has a long shadow that shoots higher, while the. Web the shooting star is a candlestick pattern to help traders visually see where resistance and supply is located. The price closes at the bottom ¼ of the range. Web a shooting star pattern is a powerful bearish reversal candlestick pattern that occurs after an uptrend in trading. The distance between the highest price of the day and the opening. Web a shooting star candlestick pattern is a bearish formation in trading charts that typically occurs at the end of a bullish trend and signals a trend reversal. Web the shooting star candle is a reversal pattern of an upwards price move. The upper shadow is about 2 or 3 times the length of the body. It has a bigger. Little to no lower shadow. Morning, evening, doji, and shooting. Web a shooting star candlestick is a type of price chart pattern that is created when a security’s price increases initially after opening and then falls close to the opening price before the market closes. It is formed when the price is pushed higher and immediately rejected lower so that it leaves behind. Similar to a hammer pattern, the shooting star has a long shadow that shoots higher, while the open, low, and close are near the bottom of the candle. The price closes at the bottom ¼ of the range. Police responded to a call about gunshots shortly after 2 a.m. How does a shooting star candlestick work? Web what is a shooting star pattern? The pattern forms when a security price opens, advances significantly, but then retreats during the period only to close near the open again. Web the shooting star is a candlestick pattern to help traders visually see where resistance and supply is located. Web a shooting star pattern is a powerful bearish reversal candlestick pattern that occurs after an uptrend in trading. That being said, you can also have variations of the two. It is formed when a candlestick opens and moves up but after that price moves down coming back to the opening price and closes near the opening price leaving a long wick to the upside called tail. This pattern is the most effective when it forms after a series of rising bullish candlesticks. It has a bigger upper wick, mostly twice its body size.Shooting Star Candlestick Pattern How to Identify and Trade

Shooting Star Candlestick Pattern How to Identify and Trade

How to Trade the Shooting Star Candlestick Pattern IG International

How To Trade Blog What Is Shooting Star Candlestick? How To Use It

A Complete Guide to Shooting Star Candlestick Pattern ForexBee

Learn How To Trade the Shooting Star Candle Pattern Forex Training Group

Tutorial on Shooting Star Candlestick Pattern

Understanding the Significance of Shooting Star Candlestick in Trading

Shooting Star Chart Pattern

Learn How To Trade the Shooting Star Candle Pattern Forex Training Group

This Pattern Is Characterized By A Long Upper Shadow And A Small Real Body Near The Low Of The Trading Range, Indicating Potential Weakness Among The Buyers.

On The 1200 Block Of North Alden.

Each Bullish Candlestick Should Create A Higher High.

It Is A Bearish Candlestick Pattern Characterized By A Long Upper Shadow And A Small Real Body.

Related Post: