Triple Top Pattern

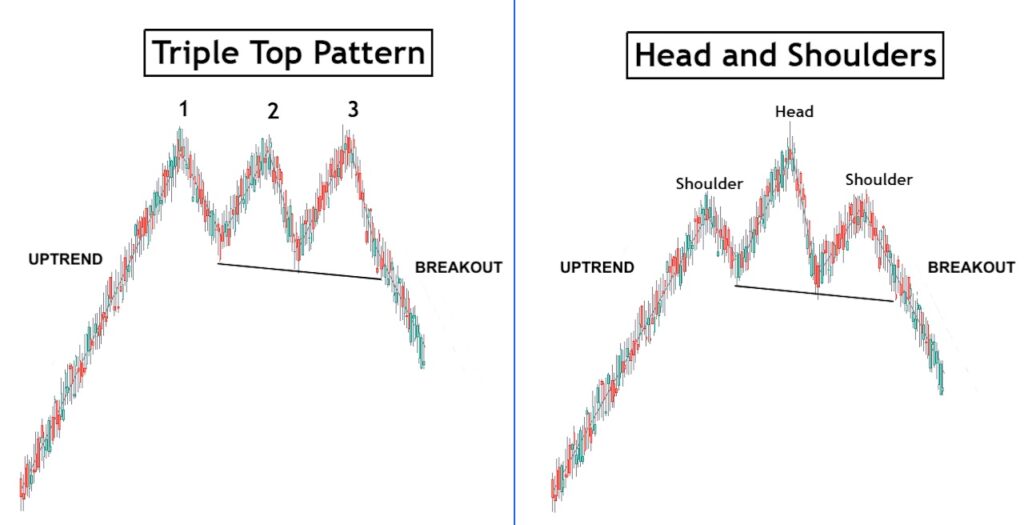

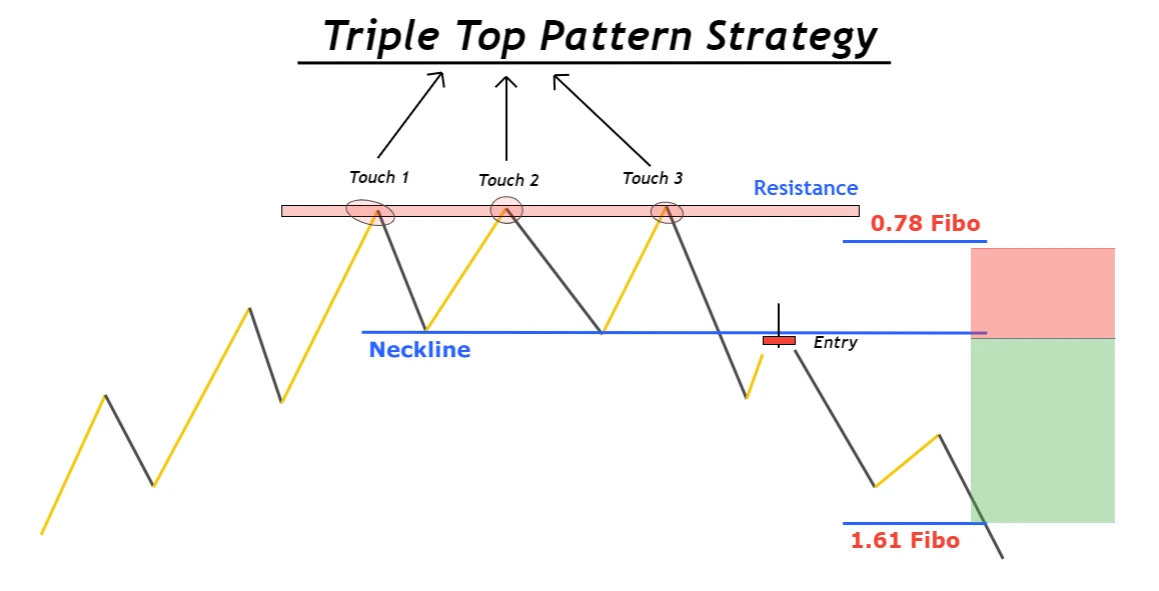

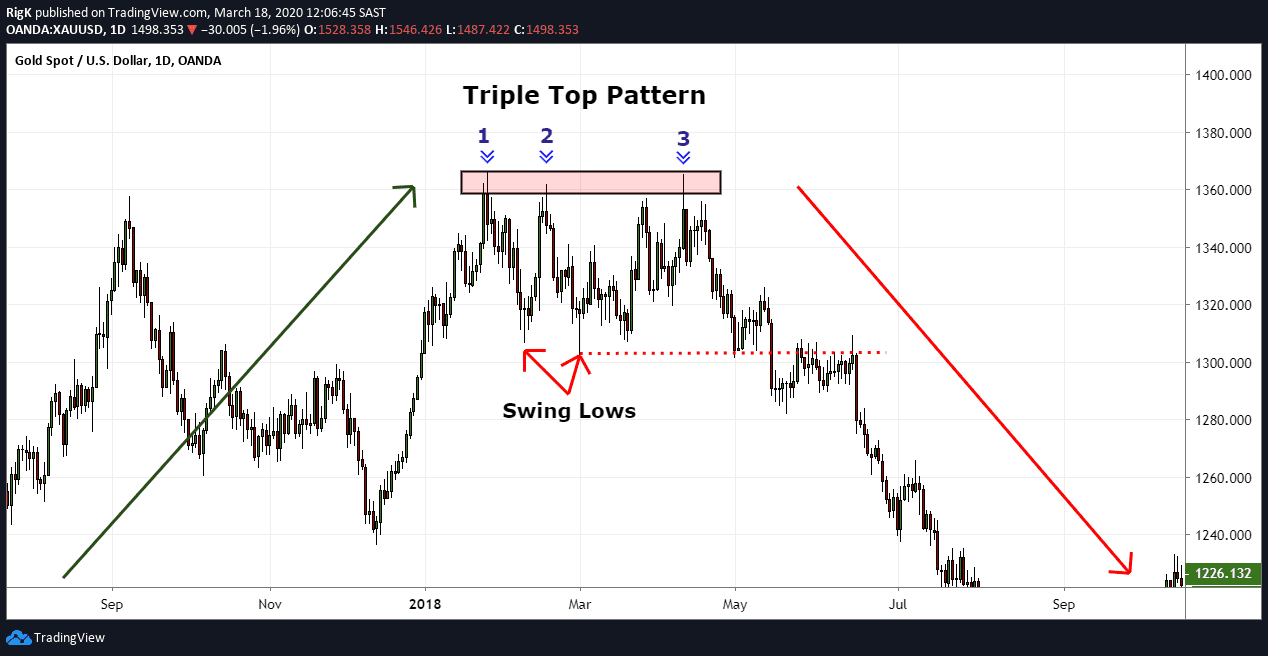

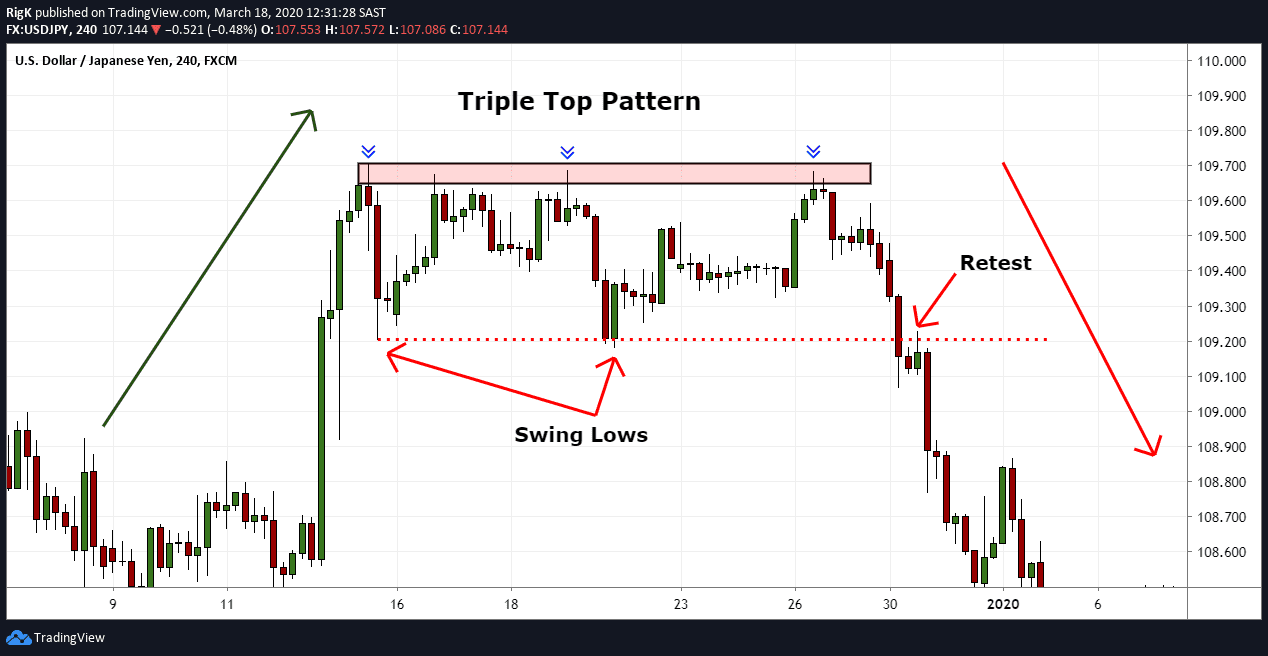

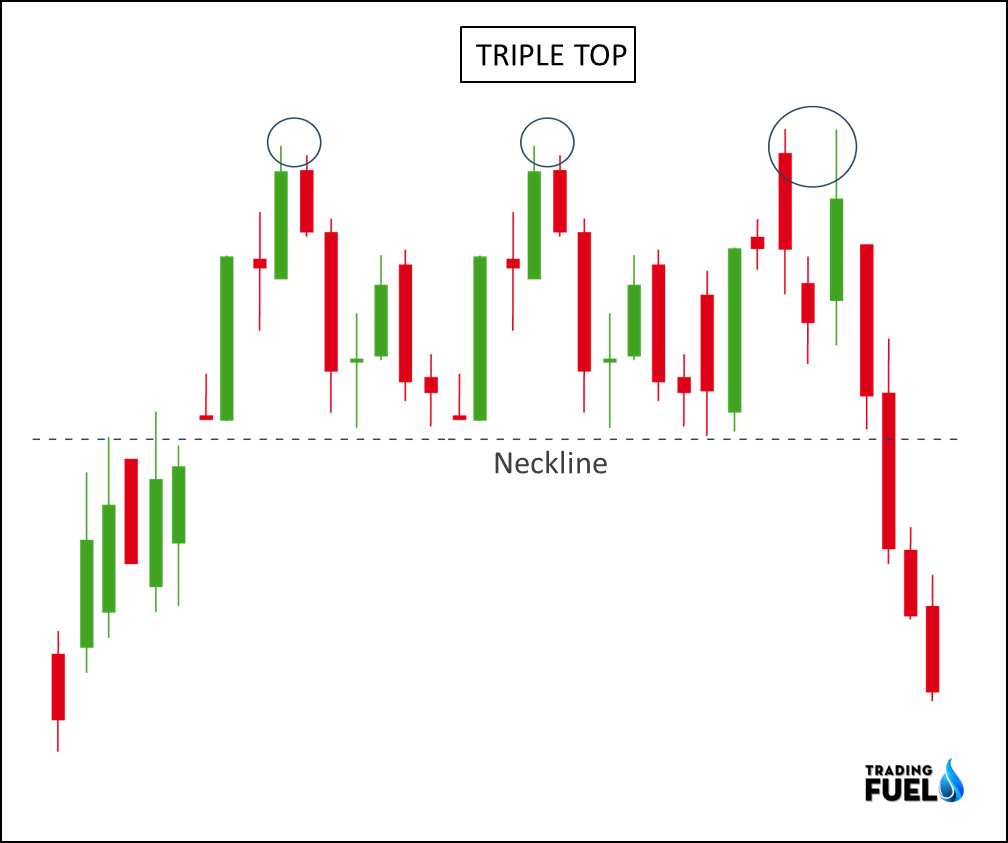

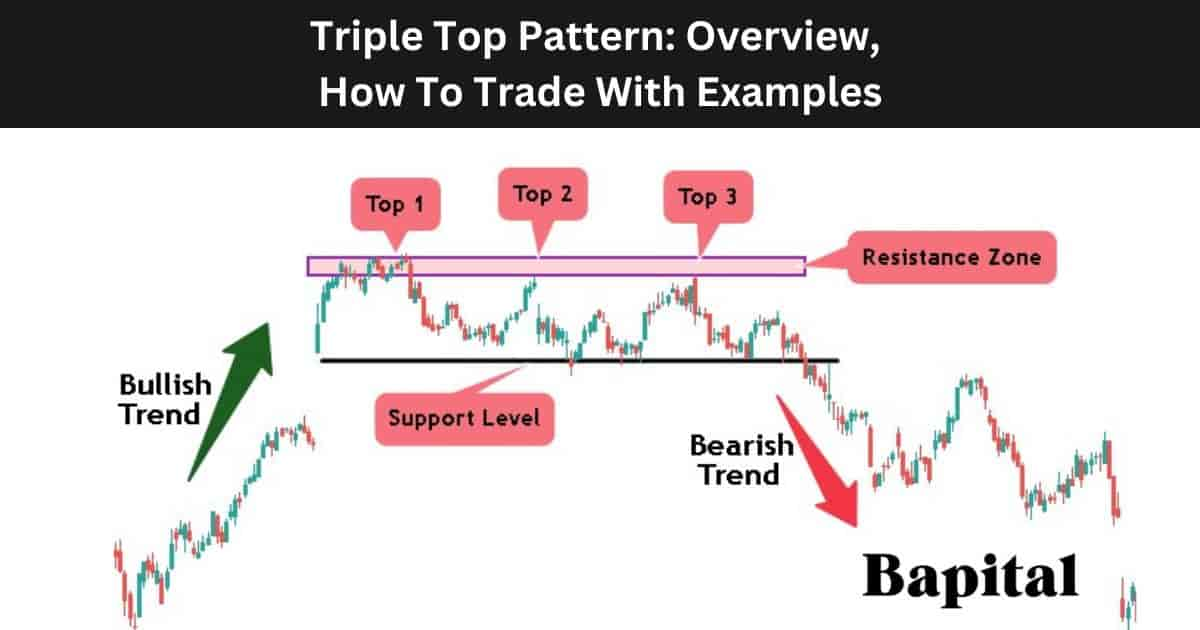

Triple Top Pattern - This chart pattern depicts three. The chart pattern is categorized as a bearish reversal pattern. Web triple top is a reversal pattern formed by three consecutive highs that are at the same level (a slight difference in price values is allowed) and two intermediate lows between. This is a sign of a tendency towards. Web the triple top pattern is a reversal formation that technical analysts use to identify potential trend changes on financial charts. Because it presents itself in the. It is very dependable in stock chart patterns used in technical. A triple top or triple peak is a bearish chart pattern. Web put simply, the triple top stock pattern indicates a potential shift from an uptrend to a downtrend, signaling that bullish momentum may be ending. Web what is the triple top pattern? It is very dependable in stock chart patterns used in technical. This is a sign of a tendency towards. Web the triple top pattern is a reversal formation that technical analysts use to identify potential trend changes on financial charts. Web a triple top pattern consists of several candlesticks that form three peaks or resistance levels that are either equal or near equal height. Web a triple top is a bearish reversal chart pattern that signals the sellers are in control (the opposite is called a triple bottom pattern). Triple top is a bearish pattern. Web the triple top stock pattern is a type of chart pattern that traders use to predict the reversal of a stock’s price. The decline will be the greater, the greater was the rise that. Stronger reversals tend to happen to stronger trends: Web a triple top is formed by three peaks moving into the same area, with pullbacks in between, while a triple bottom consists of three troughs with rallies in the. Web learn about a triple top pattern which is a bearish reversal pattern that forms on charts when the price forms three prominent swing high resistance levels and. Web a triple peak or triple top is a bearish chart pattern in the form of an mn. After reaching a certain price. Triple top is a bearish pattern. Here’s how it. This chart pattern depicts three. Web what is the triple top pattern? Web a triple top pattern consists of several candlesticks that form three peaks or resistance levels that are either equal or near equal height. Three peaks follow one another, showing significant resistance. Web a triple top pattern, also called a triple top reversal, is a charting pattern used. Web the triple top pattern occurs when the price of an asset creates three peaks at nearly the same price level. Web triple top pattern is a bearish reversal pattern that forms after an extended uptrend. Web put simply, the triple top stock pattern indicates a potential shift from an uptrend to a downtrend, signaling that bullish momentum may be. Web a triple peak or triple top is a bearish chart pattern in the form of an mn. Here’s how it looks like… let. Web what is a triple top pattern? This chart pattern depicts three. Web the triple top stock pattern is a type of chart pattern that traders use to predict the reversal of a stock’s price. Web what is the triple top pattern? Web a triple top is a bearish reversal chart pattern that signals that buyers are losing control to the sellers. Web the triple top pattern is a crucial chart pattern in technical analysis that helps traders predict price reversals in financial markets. Stronger reversals tend to happen to stronger trends: Web a triple. Web triple top pattern is a bearish reversal pattern that forms after an extended uptrend. Web a triple top is formed by three peaks moving into the same area, with pullbacks in between, while a triple bottom consists of three troughs with rallies in the. Web a triple top pattern can form when an asset in an uptrend — or. Web what is the triple top pattern? Web what is a triple top pattern? The triple top pattern consists of three. This chart pattern depicts three. This is a sign of a tendency towards. It signifies a potential shift in market sentiment from bullish to bearish. Web the triple top stock pattern is a type of chart pattern that traders use to predict the reversal of a stock’s price. Web triple top is commonly regarded as a bearish reversal pattern. Web what is the triple top pattern? The decline will be the greater, the. Web learn about a triple top pattern which is a bearish reversal pattern that forms on charts when the price forms three prominent swing high resistance levels and. Web a triple top pattern can form when an asset in an uptrend — or even a parabola — encounters resistance and slows its gains. Web a triple peak or triple top. Triple top is a bearish pattern. Web a triple top pattern consists of several candlesticks that form three peaks or resistance levels that are either equal or near equal height. The decline will be the greater, the greater was the rise that. Web a triple peak or triple top is a bearish chart pattern in the form of an mn.. Web a triple top is a bearish reversal chart pattern that signals that buyers are losing control to the sellers. Web a triple top is a bearish reversal chart pattern that signals the sellers are in control (the opposite is called a triple bottom pattern). Web put simply, the triple top stock pattern indicates a potential shift from an uptrend to a downtrend, signaling that bullish momentum may be ending. Web a triple top pattern, also called a triple top reversal, is a charting pattern used in technical analysis that signals a potential reversal. Web the triple top pattern is a bearish reversal pattern that occurs at the end of an uptrend and consists of three consecutive tops along with the same resistance level. A triple top or triple peak is a bearish chart pattern. Web triple top is a reversal pattern formed by three consecutive highs that are at the same level (a slight difference in price values is allowed) and two intermediate lows between. The area of the peaks is resistance. It signifies a potential shift in market sentiment from bullish to bearish. Web triple top is commonly regarded as a bearish reversal pattern. Web a triple top pattern can form when an asset in an uptrend — or even a parabola — encounters resistance and slows its gains. Web what is the triple top pattern? Web a triple top pattern consists of several candlesticks that form three peaks or resistance levels that are either equal or near equal height. Here’s how it looks like… let. After reaching a certain price. Thus, it’s commonly interpreted as a sign of a coming.Triple Top What It Is, How It Works, and Examples

Multiple Bottom Pattern

Triple Top Pattern A Technical Analyst's Guide ForexBee

Triple Top Chart Pattern Trading Strategy

Triple Top Pattern A Guide by Experienced Traders

What Are Triple Top and Bottom Patterns in Crypto Trading? Bybit Learn

Triple Top Pattern A Guide by Experienced Traders

Chart Pattern Triple Top — TradingView

Double Top Pattern Definition How to Trade Double Tops & Bottoms

Triple Top Pattern Overview, How To Trade With Examples

Triple Top Is A Bearish Pattern.

Three Peaks Follow One Another, Showing Significant Resistance.

It Is Very Dependable In Stock Chart Patterns Used In Technical.

Web The Triple Top Pattern Is A Crucial Chart Pattern In Technical Analysis That Helps Traders Predict Price Reversals In Financial Markets.

Related Post:

:max_bytes(150000):strip_icc()/dotdash_Final_Triple_Top_Dec_2020-01-78a37beca8574d169c2cccd1fc18279d.jpg)